The investment drought of the past two decades is catching up with us

[ad_1]

In all the converse of “building back better” and producing economies “match fit”, “strategically autonomous” and “resilient”, there is an unspoken but tragic premise. For a long time, most sophisticated economies did not establish their long term but languished in an financial commitment drought, the scandal of which is larger for staying unacknowledged.

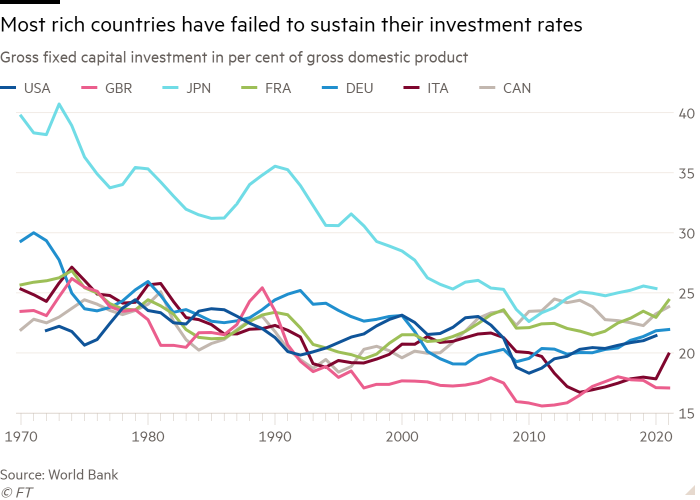

Concerning 1970 and 1989, the share of gross domestic item devoted to financial commitment by six of the world’s 7 most significant economies averaged from 22.6 per cent for the US to 24.8 for every cent for Germany. The seventh, Japan, was an outlier with 35 for every cent.

Of the G7, only Canada has sustained this level of financial investment: its 22.5 for each cent in this millennium is scarcely down from 22.8 again then. All the many others have only managed to match their 1970-89 investment decision stages in four situations: the US in the increase decades of 2000 and 2005-06, and France in 2021.

But these previous 20 several years have been the period of reduced-than-ever financing fees, 1st simply because of sector exuberance, then many thanks to central banks’ ultra-lax monetary coverage. And what do we have to present for all that inexpensive credit history? Two missing many years for financial commitment. As economics author Annie Lowrey concisely puts it, “we blew it”.

France and the US have invested practically two proportion points of GDP much less this century than they did in the 1970s and 1980s Germany and Italy about 4.5 points less the Uk and Japan 6 and 10 percentage details less respectively. These are tremendous numbers. The G7 account for about $45tn in once-a-year GDP. Restoring their investment decision ratios could fill almost fifty percent the global shortfall to the $4tn the Global Vitality Agency phone calls for in annual clear technological know-how financial commitment if we are to satisfy web zero by 2050.

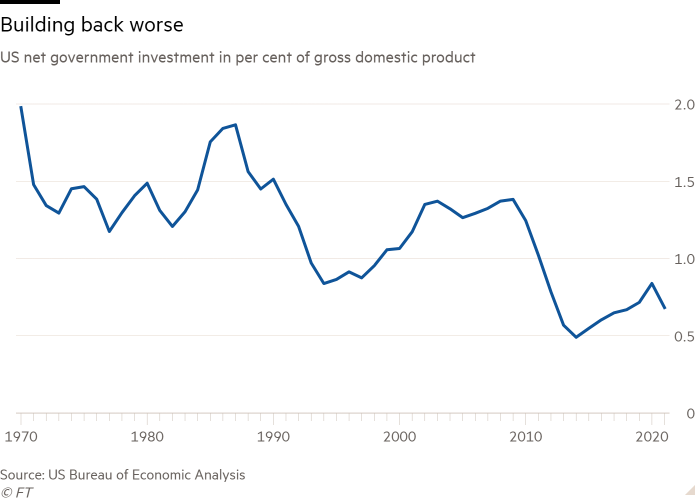

Those people are complete expense quantities, but a similar story holds for the community sector on its very own. In the US, web governing administration financial commitment (immediately after accounting for depreciation of the present general public capital inventory) fell by practically two-thirds in the ten years to 2014, when it dropped to .5 per cent of GDP.

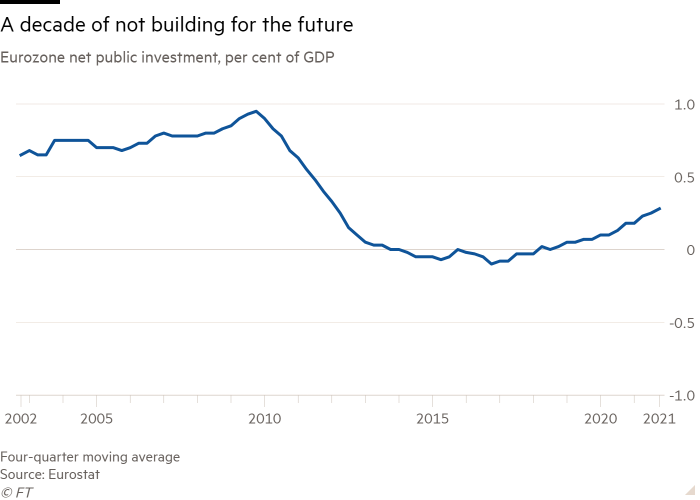

In the eurozone, web public expenditure went detrimental in the very same 12 months, thanks to extraordinary fiscal austerity in the eurozone periphery and continual beneath-investment decision in Germany.

Some will be tempted by claims that we will need not get worried. It is regular to spend fewer as you get richer — so 1 argument goes — simply because incorporating to an presently massive capital inventory is significantly worthless. The value of capital merchandise has fallen, so the very same money buys you extra true financial investment, goes another. A third is that the present-day overall economy wants intangible, not physical capital, and when this is more challenging to measure, countries seem to be doing better on that entrance.

Still this sort of reassurances, even if factually correct, are no use. No just one who usually takes a close glimpse at most western countries’ bodily infrastructure can assume it in good shape for objective — not when that objective expands to incorporate decarbonising our industries and electrical power and transportation systems.

Why have we lived for so long off earlier investments and failed to make plenty of new types? Financing prices have plainly not been the difficulty, with interest fees at history lows. (Disaster-hit eurozone countries in the sovereign debt disaster were being the exception, but even Spain and Italy have out-invested Britain for many years.)

Far more probable culprits are a deficiency of demand from customers and inexpensive labour. Companies that really don’t be expecting sufficient demand from customers to take in expanded output have no reason to invest. And when they are permitted to deal with workers as affordable and disposable, they could choose that about irreversible money investments. This is why a lot quicker wage progress and the so-called “labour shortages” (definitely competition for workers) are one thing we should really embrace if we are to prod organizations into effective investments.

Some thing equivalent may possibly have been real for low-priced strength in Europe. The 2010s had been a time of unusually lower-charge pure fuel and hence electric power. This may have undermined the urgency of investing in each bigger renewable generation and geopolitically safe and sound organic gas developments. Oil rates, also, ended up low for a great deal of the 10 years.

But underneath these financial things, I believe our failure to spend is profoundly political. Elevating the financial investment-to-GDP ratio, no matter whether by means of boosts to non-public or general public financial investment, or the two, implies that a smaller sized ratio of GDP is still left in excess of for consumption. Even if this prepares a far better upcoming, it can feel like a measlier existence currently. And that is one thing a era of politicians across the loaded earth have been concerned to inflict on their voters.

That is legitimate in very good occasions, when transfer payments, tax cuts and quick general public merchandise are all politically a lot more interesting than cash financial investment. (One thing equal is at perform in the non-public sector: witness companies’ decision to return income to entrepreneurs through share buybacks fairly than make investments in their individual growth.) It has also been real in undesirable times, when investment decision is the least complicated expenditure for belt-tightening governments and firms to cut.

European countries have arrive to rue how they made use of the “peace dividend” of 1989 to reduce defence paying. The exact second pushed the west as a full to forget about the broader plan of brief-time period sacrifice for a extra prosperous foreseeable future. But this is not inescapable, as exceptions these as Canada and the Nordics’ sustained expense demonstrate. Western voters and governments have both equally unlearned the virtue of delayed gratification. They have to relearn it, and speedy.

[ad_2]

Source link