[ad_1]

Previous month, Tether issued its most up-to-date quarterly assurance impression. The issuer of USDT announced that its reserves now exceeded its liabilities.

This ought to have eased fears around Tether’s placement as the single arbiter of the world’s most significant stablecoin in market place cap. As an alternative, it was achieved with mixed reviews, with some questioning the report’s authenticity and many others using issue with the alter in its reserve belongings allocation.

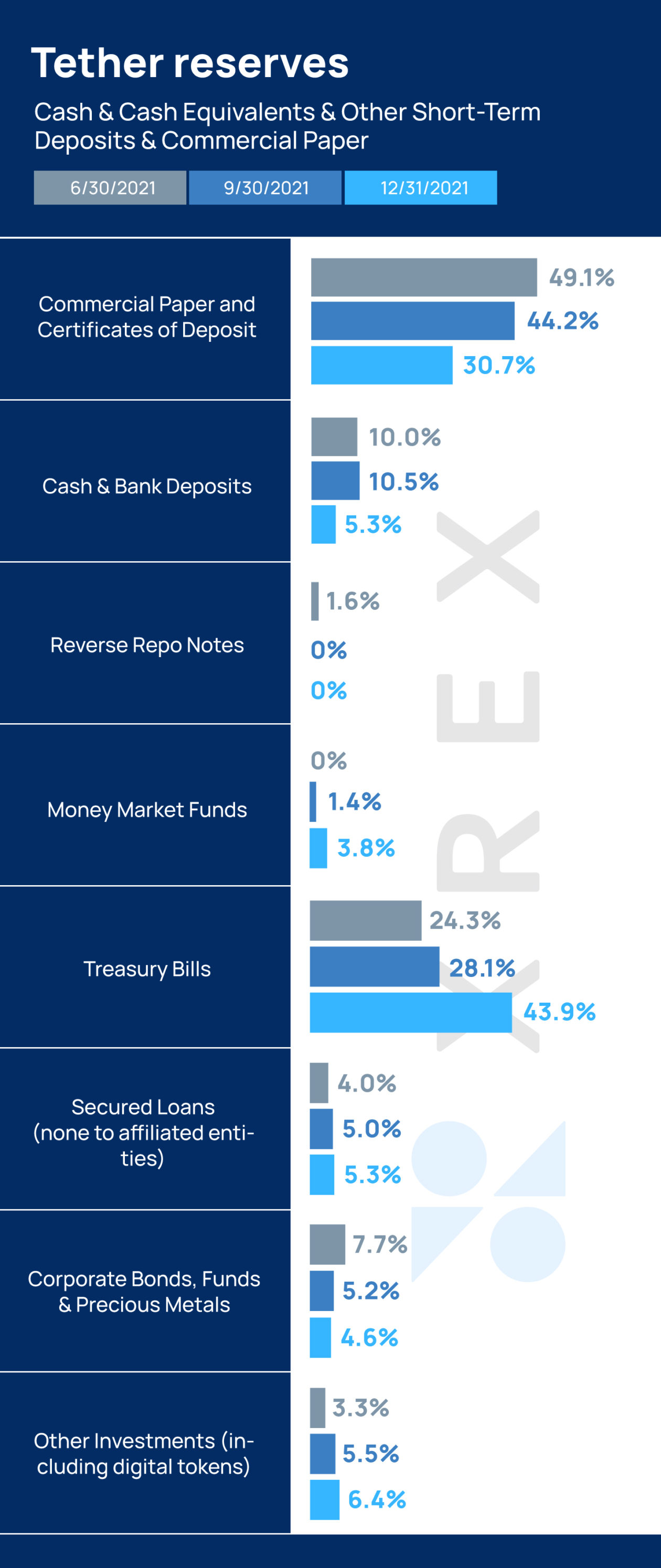

XREX has looked at Tether’s reserve assets allocation and in comparison it with what we believe forms draft advice from the U.S. regulatory authorities. (You should be aware that we are unable to verify and remark on the authenticity of the audit independently, so we will make our scenario centered on the facts disclosed by Tether.) We believe that that in comparison to prior to, Tether’s existing belongings allocation is closer to what regulators are looking for with stablecoin issuers. We would also argue that even with its reduction in dollars, Tether’s collaterals have enhanced above the previous two quarters.

From dollars to resources and T-bills

At the close of 2021, Tether documented its consolidated overall belongings amount of money to at least roughly US$78.68 billion, whilst its consolidated complete liabilities sum to about US$78.54 billion, of which about US$78.48 billion relates to digital token issuance. This means that what Tether has in belongings now outweighs the USDT tokens it has issued. But how various is the asset allocation now, and how’s the asset top quality?

When compared to its report introduced in September 2021, Tether decreased its hard cash and lender deposits by 42%, to US$4.187 billion, and its business papers by about 21%, from US$30.5 billion to US$24.16 billion. It greater its allocation to dollars industry funds by 200% to $3 billion, and its Treasury expenses by 77.6% to $34.52 billion.

This go may have been seen as Tether lessening its “cash in the lender,” as a result subjecting alone to bigger risk now that the USDT is backed by a lesser “bank deposit.” Some in the crypto neighborhood feel much more comfortable with stablecoin issuers owning 1:1 USD deposits at commercial banking companies, and this transfer wasn’t been given well.

On the other hand, Tether’s collaterals have improved its share of Treasury bills and lessened its publicity to professional papers, which count on the creditworthiness of personal corporations. By raising its share of higher-top quality liquid property, Tether is strengthening its liquidity under anxiety and transferring toward a a lot more resilient stablecoin.

Stablecoin threats: run, payment process, electrical power concentration

In November 2021, the President’s Doing the job Group on Financial Markets (PWG) issued a report on stablecoins that highlighted regulatory gaps and outlined tips to deal with those people gaps. The operating team was led by Dr. Nellie Liang, the U.S. undersecretary of the Treasury for Domestic Finance and a seasoned economist who spent just about 30 many years at the Federal Reserve ahead of her recent appointment. Her in-depth information of the economical procedure and her comprehension of the stablecoin market make it essential for the crypto community to read through how economists and regulators alike could examine the stablecoin current market.

The PWG report highlighted 3 important hazards in the latest stablecoin ecosystem, particularly: run hazards, payment technique pitfalls, and focus of economic electrical power. These risks convey about fears about liquidity and operational availability through a disaster. It also signifies the need to lower the focus of electric power and enhance interoperability. In this article, we search at two of the pitfalls highlighted: run risk and liquidity.

Asset diversification can decrease stablecoin risks

In her testimony to the Senate Committee on Banking, Housing and City Affairs on Feb. 15, Dr. Liang mentioned: “History has revealed that, without suitable safeguards, financial institution deposits and other sorts of personal cash have the prospective to pose threats to individuals and the financial program.”

Dr. Liang cited the threat of a “stablecoin run,” where by people today reduce assurance in instances of pressure or uncertainty and hurry to withdraw or provide their stablecoin belongings, environment off a wave that impacts the broader regular finance procedure. We observed this all through the 2008 liquidity crisis.

If a stablecoin operate occurs and holders provide USDT en masse, it will induce crypto exchanges to massively redeem with Tether.

Superior-good quality liquid assets

There is a paramount need to have for Tether to possess superior-high quality assets to tackle two situations that will most likely outcome in a operate: one is in the course of a global disaster when folks hurry to liquidate their belongings as they desire to have bigger liquidity on hand to tide via, and two, when a operate from Tether comes about.

The PWG report implied that stablecoins must be backed one-for-a single by “high high quality liquid assets.” When requested in the course of her testimony to evaluate the hazard of a operate in between a completely-reserved stablecoin as opposed to a fractional reserve bank, Dr. Liang said: “For illustration, a cash sector fund — totally reserved, 100%, substantial-excellent property — have incredibly limited reserve run.” She also mentioned that fractional reserve banking can reduce operates if backed by deposit coverage, loan provider of last resort, or low cost window amenities, and blended with regulation of the belongings.

Nevertheless, it is obvious in this occasion that in Dr. Liang’s see, the more substantial the part of larger-high quality property, the decrease the risk of a run. In contrast, fractional reserve banking and the inherent leverage therein suggests that commercial banks can working experience operate possibility under stressful problems main to uncertainty regarding the availability of dollars held as financial institution deposits.

The 2007-2008 economical crisis demonstrated the vulnerabilities of the standard banking procedure, such as the perceived protection of commercial bank deposits. The planet begun reeling from the subprime property finance loan disaster in 2007. In the following 12 months, investment lender Bear Stearns confronted liquidity difficulties due to their overexposure to home finance loan securities and necessary a Fed bailout. Like Bear Stearns, Lehman Brothers was remarkably uncovered to home finance loan-backed securities and experienced the major personal bankruptcy in historical past. The firm’s overleveraged publicity had thrown them into a downward spiral against a deteriorating economical environment.

It was below this backdrop of fiscal system tension that Satoshi Nakamoto printed the historic Bitcoin white paper on Oct. 31, 2008.

The message “The Occasions 03/Jan/2009 Chancellor on the brink of 2nd bailout for banks” was enshrined on Bitcoin’s genesis block. This was Satoshi’s message to all of us, a warning about the vulnerability and precariousness of the regular banking program.

It is increasingly very clear that Tether now needs to be extremely mindful and nimble with its reserve allocation, dependent on today’s economic circumstances. Evaluating Tether’s reserve allocation will have to incorporate limited- and lengthy-term financial outlook, to make certain that any stablecoin issuer can fulfill its token liabilities in any industry affliction.

Conclusion

Because of the explanations stated previously mentioned, if Tether proceeds on this path, it will lessen its dangers in times of pressured market disorders and proceed to be a steady anchor to crypto marketplaces, particularly to the numerous DeFi tasks that are built upon USDT.

We are at the cusp of seeing much more express laws that will set parameters for stablecoin issuers. In his opening statement at a Senate Committee listening to, rating member Pat Toomey commented on the PWG report saying, “Rather than count on the ‘flexibility’ of the current framework for depository establishments, which leaves total discretion to financial institution regulators, it is the accountability of Congress to design and style this technique.”

It is clear from the hearings that U.S. lawmakers are fascinated in viewing a number of USD-pegged stablecoins be successful, as that will even further reinforce the USD as the dominant world-wide reserve currency. With that target in brain, it is only a subject of time just before we see extra regulatory frameworks staying rolled out to foster and accelerate the expansion of stablecoin adoption.

Stablecoins will participate in a important role in cross-border payments, intercontinental clearance and settlements in the in the vicinity of long term, and we will continue to keep an eye on their developments carefully, towards a long term where cryptocurrency operators and money establishments function hand-in-hand to provide better money inclusion to all.

[ad_2]

Source hyperlink