[ad_1]

AsiaVision/E+ via Getty Images

Investment Thesis

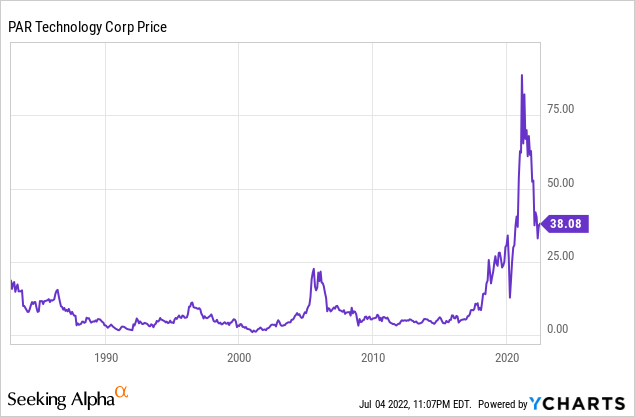

PAR Technology (NYSE:PAR) was one of the winning companies in the pandemic. Its stock rose from around $11 back in March 2020 to over $88 in February 2021, representing an 800% increase within a year. However, the company got caught in the high-growth tech sector sell-off, and the share price has dropped by over 55% from its all-time high, now trading at $38.08. PAR has been around for a long time. The US-based company was founded in 1968 and went public in 1982. It started off as a tech contractor and provide POS (point of sale) systems to different companies. However, it received little love as the business was very underwhelming, and the share price remained flat for almost 40 years. Current CEO Savneet Singh stepped in during 2019 and decided to turn the ship around by transforming PAR Technology from a service company to a SaaS (subscription as a service) company. This resulted in a huge success, with ARR (annual recurring revenue) increasing by over 400% in less than three years.

Savneet Singh, CEO, on the company’s vision:

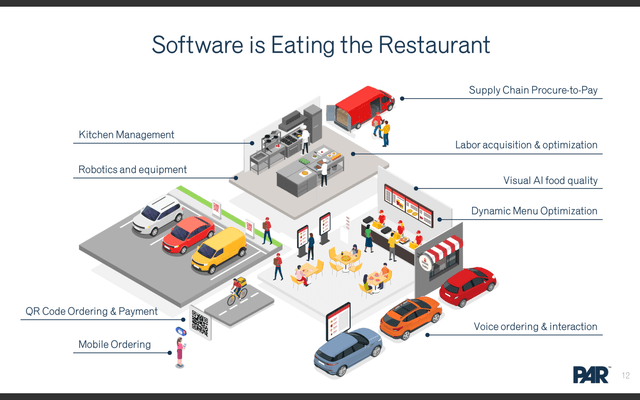

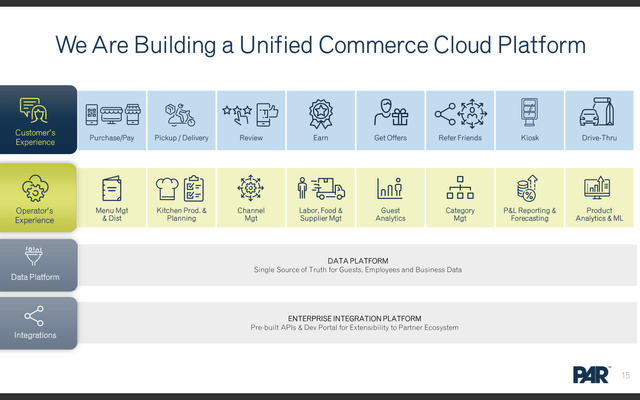

We continue to work to advance the enterprise restaurant industry vision of autonomous restaurants with our focus on creating a single cloud-based platform that is designed to enable staff and tech enabled restaurant operations. Unified Commerce connects all the guest facing channels – website, app, in-stores, third party deliveries – with one common technology platform that is built on the Open Web standards. This is an evolution in the industry from multichannel and omnichannel platforms which still require brands to do the heavy duty integration, often at their own peril.

The restaurant software and POS market are also huge as restaurants are now changing their operating system in order to improve efficiency. However, even after the large drop in share price, the company is still trading at a premium compared to peers that are growing at similar levels. Despite the strong top-line growth, profitability remains a big issue. Therefore, I believe PAR Technology is a hold for now and will upgrade it to a buy when profitability improves and valuation becomes more appealing.

PAR Technology

Market Opportunity

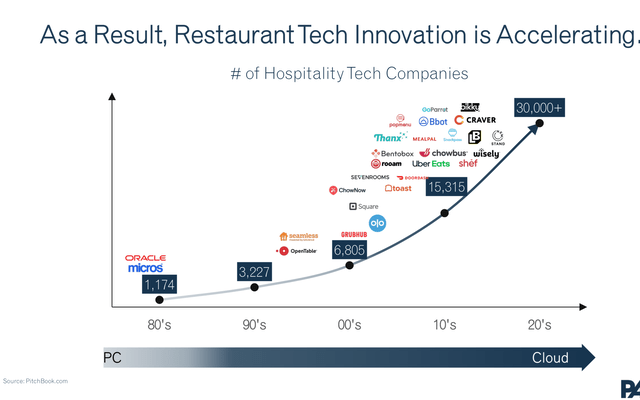

PAR Technology is operating in the restaurant software and POS space, which has a huge TAM (total addressable market). This is due to the shift from legacy operating platforms to modern cloud-based operating platforms. Restaurants are now seeking ways to improve efficiency, and the modern operating system allows them to have a unified platform that consolidates all data. The platform can also address multiple needs like purchases, analytics, loyalty, menu management, and more. It is also able to offer more capabilities like omnichannel ordering and personalized engagement. According to PAR, currently, only around 10%-20% of enterprises have migrated to a pure cloud operating platform. I believe the shift will continue to accelerate as restaurants are looking to move to a more efficient and flexible platform.

The restaurant industry is one of the largest industries in the world. According to Toast, the annual sales for the US restaurant industry alone are $800 billion, representing 3% of GDP. The TAM for the US is estimated to be $50 billion, while TAM for the rest of the world is estimated to be $110+ billion. The POS market is also growing quickly. According to Markets and Markets, the market size of POS is $15.8 billion in 2020 and is estimated to grow to $34.4 billion by 2026, representing a CAGR (compounded annual growth rate) of 13.9%. This provides a huge market for PAR to expand into moving forward.

Savneet Singh, CEO, on market trends:

“We are at an exciting time in our industry, as restaurants large and small transform and modernize to become software-driven, digital enterprises. Our Q1 results reflect the power of our platform and integrating Punchh with Brink and Data Central and we closed several large brands who chose multiple PAR solutions in the quarter. These recent customer wins demonstrate the accelerating demand for Unified Commerce where restaurants require simpler solutions, fewer integrations and more natively unified solutions.”

PAR Technology

Competitors

With the restaurant software and POS space being such a huge market, competition is quite fierce. PAR Technology has multiple competitors which include Toast (TOST), Lightspeed (LSPD), Block (SQ), and Shopify (SHOP). Block and Shopify provide POS systems mainly for SMBs, while Lightspeed POS targets the medium-high end niche. Toast is the main competitor which focuses solely on restaurants. Both companies have a strong and comprehensive products, but they operate quite differently. Toast is targeting restaurants of all sizes and offers a free plan to attract customers on board. It then upsells different products like marketing and inventory management to customers to increase its ARPU (average revenue per user). While PAR Technology is differentiating itself by mainly focusing on the enterprise restaurant market. I believe this is a very smart move as it allows them to charge a higher-priced plan and generate more revenue from the start. It also makes them immune to competition from Shopify and Block, as they focus mainly on SMBs. Enterprise restaurants also have a higher spending power compared to small and medium-sized restaurants, which give PAR Technology a higher ARPU.

PAR Technology

Financials and Valuation

PAR Technology announced its Q1 earnings in May and its growth rate remains very impressive. The company reported revenue of $80.3 million, up 47.4% YoY (year over year) from $54.5 million. Gross profit was $20.6 million compared to $10.2 million, representing a 102% increase YoY. This is largely driven by the explosive growth in ARR. ARR at the end of Q1 was $94.4 million, a 172% increase from $34.6 million a year ago. Punchh, its loyalty division, delivered a YoY ARR growth of 39% while Brink, its POS division, delivered a YoY ARR growth of 35%. Active sites for Punchh and Brink are 58,801 restaurants and 16,945 restaurants, respectively.

However, the bottom line remains quite weak. The net loss for the quarter was $(15.7) million, or $(0.58) net loss per share, compared to a net loss of $(8.3) million, or $(0.38) net loss per share. The adjusted EBITDA loss was $(2.9) million, compared to an Adjusted EBITDA loss of $(4.9) million a year ago. The widening in net loss is largely due to the increase in R&D expense, which increased 87% YoY from $5.8 million to $10.8 million. Operating cash flow was negative $(21.2) million, compared to a negative $(3.4) million a year ago. The company’s balance sheet remains solid. It ended the quarter with $163 million in cash and $392 million in debt, which leaves the company with net debt of $229 million. However, $387 million of the debt is long-term debt, therefore the company is in no rush to pay down the debt any time soon.

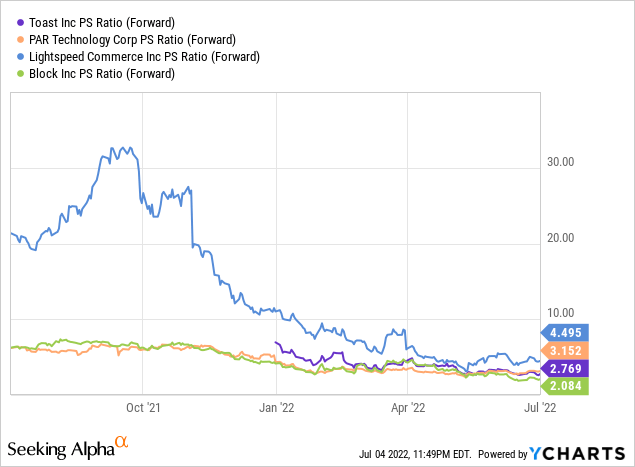

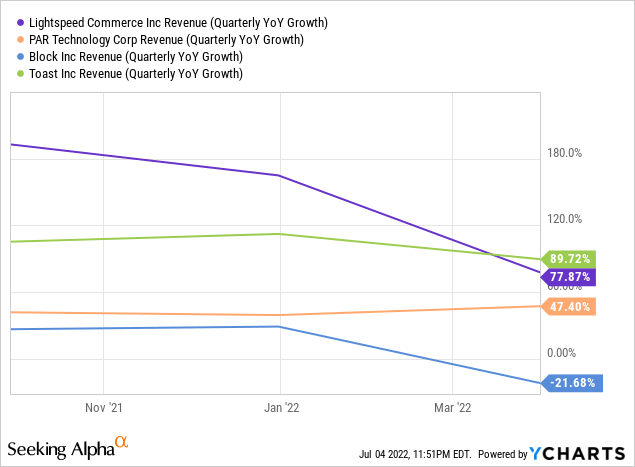

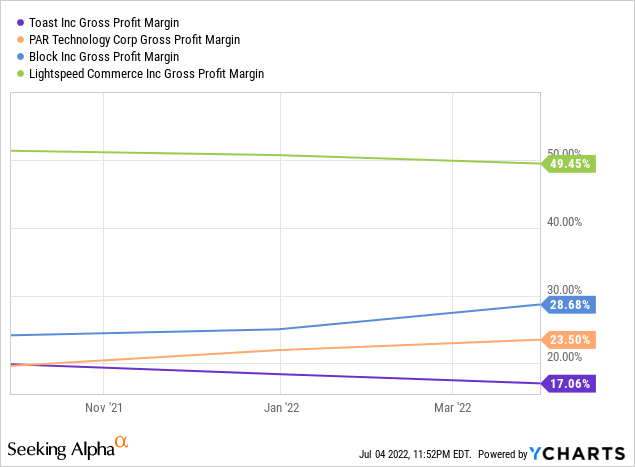

Despite the big drop in share price, PAR Technology is still trading at an elevated level. I am valuing the company using the P/S ratio, as it has no earnings and positive cash flow at the moment. PAR Technology is currently trading at a fwd P/S ratio of 3.2. From the first chart below, you can see that this is elevated compared to peers. It is currently trading at a premium of 13.7% and 51.4% compared to Toast and Block, respectively. Lightspeed is the only exception, as it is growing faster and has a much higher gross margin. From the second and the third chart, you can see that Lightspeed has a revenue growth rate of 77.9% and a gross margin of 49.5%, compared to PAR’s 47.4% and 23.5%. If we compare it to Toast, its closest competitor, we can see that Toast is actually growing quicker while trading at a cheaper valuation. I believe PAR Technology should be trading at a similar or even lower valuation when compared to Toast as they both have a similar prospect, with Toast having a stronger growth.

Macro Headwinds

The current uncertainty in the macro-environment may create headwinds for PAR in the near term. As the high inflation rate persists, the economy keeps on weakening. We are already seeing signs of cracks, with companies like Target (TGT) lowering guidance substantially and Tesla (TSLA) starting to lay off employees. Consumer purchasing power has reduced significantly and consumers are now reluctant to spend on discretionary items as most of their budget is used on essentials. This will hurt PAR Technology as restaurants are not likely to change or upgrade their POS as demand remains weak. Current customers are likely to stick around due to high switching costs which will provide some buffer, but the number of new customers is likely to decrease which will slow down its growth moving forward.

Conclusion

In conclusion, I believe PAR Technology has a huge opportunity moving forward, but profitability and valuation remain an issue. The company is benefiting from the shift from legacy restaurant software to modern cloud-based restaurant software. I believe the shift will not end anytime soon, as restaurants are continuing to seek better-operating efficiency. The TAM of the company remains huge and a lot of it is still untapped as only around 10%-20% of enterprises have migrated to a pure cloud operating platform. Competition is quite fierce, but I think PAR Technology has successfully differentiated itself by focusing mostly on the enterprise side. The company is seeing strong growth led by the exponential increase in its ARR. However, net loss and operating cash flow keep deteriorating. It is also trading at a relatively elevated level compared to the likes of Toast, which is growing even faster. Therefore, despite the strong fundamentals, I rate the PAR Technology as a hold and will revisit it when profitability improves and valuation becomes more appealing.

[ad_2]

Source link