Lithium Junior Miners News For The Month Of June 2022

[ad_1]

D3signAllTheThings/iStock via Getty Images

Welcome to the June 2022 edition of the “junior” lithium miner news. We have categorized those lithium miners that won’t likely be in production before 2023 as the juniors. Investors are reminded that many of the lithium juniors will most likely be needed in the mid and late 2020’s to supply the booming electric vehicle [EV] and energy storage markets. This means investing in these companies requires a higher risk tolerance and a longer time frame.

June saw some controversy over lithium price forecasts and a very large amount of good news from the lithium juniors. Lithium prices remained very strong.

Lithium price news

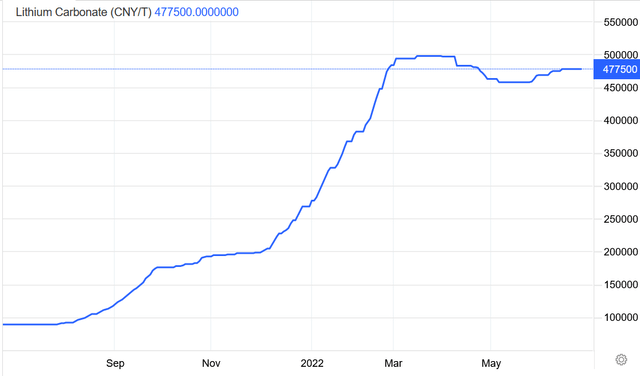

Asian Metal reported during the past 30 days, 99.5% China lithium carbonate spot prices were up 8.56% and China lithium hydroxide prices were up 0.88%. Lithium Iron Phosphate (Li 3.9% min) prices were up 0.84%. Spodumene (6% min) prices were up 9.16% over the past 30 days.

Benchmark Mineral Intelligence (“BMI”) as of mid-June reported China lithium carbonate prices of RMB 476,000 (US$70,925) (battery grade), and for lithium hydroxide RMB 484,000 (US$72,125).

Metal.com reported lithium spodumene concentrate (6%, CIF China) price of CNY 32,935 (~USD 4,918/mt), as of June 23, 2022. See also Pilbara Minerals news where their BMX auctions are achieving much higher spot prices (just over US$7,000/DMT).

China Lithium carbonate spot price – CNY 477,500 (~USD 71,315)

Trading Economics

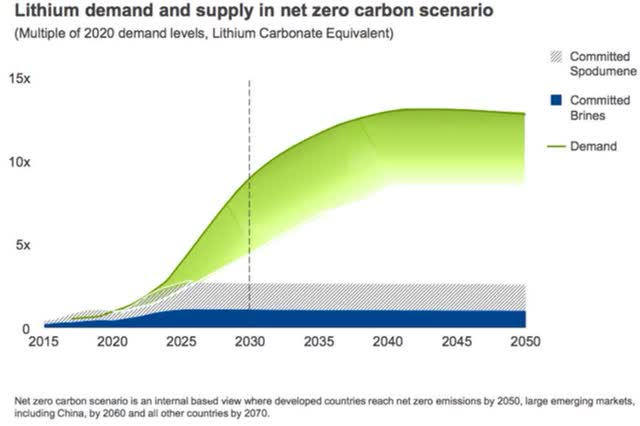

Rio Tinto’s lithium emerging supply gap chart (chart from 2021)

Rio Tinto

Source: Mining.com courtesy Rio Tinto

Lithium market news

For a summary of the latest lithium market news and the “major” lithium company’s news, investors can read: “Lithium Miners News For The Month Of June 2021” article. Highlights include:

- Congress and Pentagon seek to shore up strategic mineral stockpile dominated by China.

- Goldman says bull market in battery metals is finished for now. Still, prices could soar again after 2024.

- China’s Qinghai Salt Lake Industry to invest $10.5bln in lithium production.

- Benchmark Mineral Intelligence – Lithium oversupply? Not likely – five main reasons why.

- SA report – “Goldman wrong on lithium pessimism, specialty analysts say.”

- 3 reasons Goldman Sachs is wrong about lithium.

- Chile at risk of missing lithium boom amid political, policy instability.

- Bolivia selects lithium partners as it chooses DLE route to tap battery boom.

- VW U.S. chief warns of industry challenges with EV battery shift.

- Record price for Pilbara lithium more evidence share sell-off is overdone.

Junior lithium miners company news

Sayona Mining Ltd. [ASX:SYA] (OTCQB:SYAXF)

On May 27, Sayona Mining announced: “Successful A$190m institutional placement to fund NAL restart and broader development initiatives.” Highlights include:

- “Placement to global institutional, professional and sophisticated investors raises approximately A$190 million.

- Placement bookbuild sees significant demand from numerous high‐quality domestic and offshore institutions, providing strong endorsement of Sayona’s growth strategy.

- Proceeds to primarily fund restart of North American Lithium (NAL) operation in Québec, Canada, amid rapidly growing demand for battery metals produced in North America.

- Sayona well capitalized to progress development of its emerging Abitibi and Northern Hubs, hosting the largest combined spodumene resources in North America.”

On May 27, Sayona Mining announced: “Sayona builds Québec team for 2023 production.” Highlights include:

- “Sayona builds Québec team for 2023 production, with appointment of new Sayona Québec CFO and other corporate appointments……

- Sayona progressing multiple projects in Québec amid increasing demand from accelerating electric vehicle revolution in North America.

Appointed on 23 May, Salvatore Vitare (CPA, CA) is Sayona Québec’s new chief financial officer, responsible for overseeing all financial activities of the Company as it advances towards the commencement of spodumene (lithium) production in the first quarter of 2023.”

Investors can read the Company presentation here, and a Trend Investing CEO interview here.

Note: North American Lithium [NAL] is owned 75% Sayona Mining: 25% Piedmont Lithium.

Upcoming catalysts include:

- 2022 – Authier permitting. Possible project financing and off-take.

- Q1 2023 – Restart of NAL (SYA 75%: PLL 25%) operations.

Piedmont Lithium Inc. [ASX:PLL] (Nasdaq:PLL)

Piedmont Lithium 100% own the Carolina Lithium spodumene project in North Carolina, USA; as well as 25% of North American Lithium [NAL].

On May 24, Piedmont Lithium reported:

Piedmont Lithium partner Sayona Mining announces positive study results for North American Lithium Mine restart. Piedmont Lithium Inc. (“Piedmont” or the “Company”) (NASDAQ: PLL; ASX: PLL), a leading, diversified developer of lithium resources required to enable the U.S. electric vehicle supply chain, today announced that Piedmont’s partner, Sayona Mining [ASX:SYA], recently published a prefeasibility study (“NAL PFS” or the “NAL Study”) for the restart of spodumene concentrate operations at the North American Lithium Project in Quebec (“NAL”). The NAL PFS contemplates average annual production of approximately 168,000 tonnes per year of 6% spodumene concentrate over a mine life of 27 years. The NAL Study highlights estimated competitive cash operating costs and an estimated capital cost for the mine and concentrator restart of approximately US$80 million. Piedmont and Sayona acquired the previously-producing NAL operations in August 2021……

Upcoming catalysts include:

- 2022 – Carolina Lithium – Possible further off-take, permitting or project funding announcements.

- Q1 2023 – NAL (25% Piedmont Lithium) production set to begin.

You can view the company’s latest presentation here.

Vulcan Energy Resources Ltd. [ASX: VUL] (OTCPK:VULNF)

Vulcan Energy Resources state that they have “the largest lithium resource in Europe” with a total of 15.85mt LCE, at an average lithium grade of 181 mg/L. The Company is in the development stage developing a geothermal lithium brine operation (geothermal energy plus lithium extraction plants) in the Upper Rhine Valley of Germany.

On June 17, Vulcan Energy Resources announced:

Zero Carbon Lithium™ Project update. Local Council votes to support geothermal energy production; and exploration licence area increased by 141km 2 to a total of 1,163km2.

On June 24, Vulcan Energy Resources announced: “Stellantis to become substantial shareholder in Vulcan Energy through $76million (€50M) equity investment.” Highlights include:

- “Vulcan has agreed a A$76M (€50M) equity investment from Stellantis N.V. (NYSE / MTA / Euronext Paris: STLA, Stellantis).

- Vulcan understands that this represents the world’s first upstream investment in a listed lithium company by a top tier automaker.

- Stellantis will become the second largest shareholder in Vulcan, at 8% shareholding, following issue of the fully paid ordinary shares at the 30-day Volume Weighted Average Price (VWAP) of A$6.622 (€4.367) per share which represents ~11.450m shares.

- Use of proceeds will go towards Vulcan’s planned production expansion drilling in its producing Upper Rhine Valley Brine Field (URVBF). Vulcan is already producing geothermal energy from its URVBF and plans to produce lithium hydroxide with zero fossil fuels and net zero carbon footprint as part of the Zero Carbon Lithium™ Project.

- Vulcan and Stellantis have also extended their binding lithium hydroxide offtake agreement (see ASX release 29/11/2021) by five years, to 2035….

- Aligned with Vulcan’s mission to decarbonise and electrify transportation, Stellantis has one of the largest electrification and decarbonisation plans of any automaker globally, reaching 100% of passenger car battery electric vehicle (BEV) sales mix in Europe by 2030. In addition, Stellantis also increased planned battery capacity by 140 GWh to approximately 400 GWh, to be supported by five battery manufacturing plants in Europe and North America, together with additional supply contracts.“

Upcoming catalysts include:

- H2 2022 – DFS, potential permitting and project funding.

- 2024 – Target to commence production.

POSCO Holdings Inc. [KRX:005490] (PKX)

On June 21, Hancock Prospecting reported:

POSCO inks MOU deal with Australia’s Hancock to secure raw materials for EV batteries. Under the contract, the South Korean steelmaking company agreed to develop mines for raw materials with Hancock, such as nickel, lithium, and Hot Briquetted Iron [HBI].

Upcoming catalysts include:

- 2024 – Target to commence production at Hombre Muerto and ramp to 25ktpa LiOH.

Wesfarmers [ASX:WES] (OTCPK:WFAFY)(took over Kidman Resources)

The Mt Holland Lithium Project is a 50/50 JV between Wesfarmers and SQM (SQM), located in Western Australia. There is also a proposal for a refinery located in WA. Wesfarmers acquired 100% of the shares in Kidman for A$1.90 per share, for US$545 million in total.

No lithium news for the month.

You can view the latest company presentation here and news on the Mt Holland construction here.

Upcoming catalysts include:

- H2, 2024 – Mt Holland spodumene production and Kwinana LiOH refinery planned to begin and ramp to 45–50ktpa LiOH.

Liontown Resources Ltd. [ASX:LTR] (OTC:LINRF)

Liontown Resources 100% own the Kathleen Valley Lithium spodumene project in Western Australia. DFS completed in November 2021.

On June 6, Liontown Resources announced: “Liontown and Tesla execute binding Offtake Agreement.” Highlights include:

- “Liontown and Tesla have executed the definitive full-form agreement (Offtake Agreement) for the supply of spodumene concentrate from the Kathleen Valley Lithium Project in WA.

- The full-form agreement expands the detail on the material terms agreed in the binding terms sheet announced on 16 February 2022 and specifies the operational and logistical requirements for the delivery of product.

- Five-year term expected to commence in 2024.

- Tesla to purchase 100,000 dry metric tonnes (DMT) in the first year, increasing to 150,000 DMT per year in subsequent years.

- Pricing is determined using a formula-based mechanism referencing market prices for battery-grade Lithium Hydroxide Monohydrate.”

You can view the company’s latest presentation here.

AVZ Minerals Limited [ASX:AVZ] (OTC:AZZVF)

AVZ Minerals owns 51% of its Manono Lithium & Tin Project in the DRC, after selling 24% of it to Suzhou CATH Energy Technologies for US240m. DRC-owned firm Cominiere has a 25% share.

On June 1, AVZ Minerals announced:

Extension of end date to the transaction implementation agreement AVZ Minerals Limited (ASX: AVZ, OTCQX: AZZVF) (“AVZ” or “Company”) refers to the Transaction Implementation Agreement (“TIA”) with Suzhou CATH Energy Technologies (“CATH”) as detailed in the Company’s ASX Announcements dated 27 September 2021 “Cornerstone investor secured for development of Manono Lithium and Tin Project” and 16 February 2022 “Expedited completion of US$240M cornerstone investment with CATH”.

On June 1, AVZ Minerals announced: “Request for extension to voluntary suspension…..”

On June 17, AVZ Minerals announced:

Arbitration proceedings update. AVZ International Pty Ltd (AVZI) has filed its response to the ICC proceedings rebutting the meritless claim that La Congolaise D’Exploitation Miniere SA (Cominière) has transferred a 15% interest in Dathcom Mining SA (Dathcom) to Jin Cheng.

On June 17, AVZ Minerals announced: “Sustainability report 2020 – 2021.”

Upcoming catalysts include:

- 2022 – Initial project work. FID on the Manono Project.

Standard Lithium Ltd. [TSXV:SLI] (SLI)

No news for the month.

Global Lithium Resources [ASX:GL1]

On May 26, Global Lithium Resources announced:

Drilling commences on schedule at the Manna Lithium Project. Initial 20,000m RC drilling campaign underway…..Results to be incorporated into updated Manna Mineral Resource later this year.

On June 10, Global Lithium Resources announced: “MBLP assays continues to deliver on exploration success…” Highlights include:

- “Significant intervals of lithium mineralisation continue to be intersected from the ongoing drilling at the Marble Bar Lithium Project (MBLP) in the Pilbara Region of Western Australia.

- Results include: 11m @ 1.42% Li2O and 62ppm Ta2O5 from 25m in MBRC0258. 12m @ 0.88% Li2O and 44ppm Ta2O5 from 82m in MBRC0269. 9m @ 1.09% Li2O and 61ppm Ta2O5 from 44m in MBRC0270. 10m @ 0.81% Li2O and 80ppm Ta2O5 from 40m in MBRC0271. 7m @ 1.00% Li2O and 71ppm Ta2O5 from 24m in MBRC0300. 7m @ 1.82% Li2O and 66ppm Ta2O5 from 20m in MBRC0310.

- Wide intervals from the drilling continue to demonstrate the robustness of the MBLP and enhance the opportunities for increasing the resource base in proximity to the current Archer deposit and along strike further to the south and east.

- Ongoing drilling will target these lithium mineralised pegmatites to establish their prospectivity both along strike and down dip.

- Mapping and soils work has delineated three distinct target areas for further exploration (refer to Figure 1).

- Additional outcropping lithium targets remain untested by drilling and these areas will form part of the ongoing focus for the CY2022 drilling program.“

On June 16, Global Lithium Resources announced: “Diamond drilling contractor mobilises to Manna Lithium Project. Diamond drilling to target resource extension at depth“

Savannah Resources Plc [LSE:SAV] [GR:SAV] (OTCPK:SAVNF)

On June 21, Savannah Resources announced: “Successful completion of locked cycle testing excellent recoveries above target lithium grades.” Highlights include:

- “…..The LCT yielded a concentrate grade of 5.5% Li2O (‘SC5.5’) and global recoveries in the range of 77%-81% at laboratory scale.

- This supports the results previously reported in the ore variability programme, which achieved Li2O recoveries in the range of 70%-79.5% at laboratory scale with low levels of impurities, and suggests that improved levels of recoveries are achievable…..

- These positive results will be utilised in resource and mine optimisation, and as the basis for the upcoming DFS to support the proposed development.

- Based on the encouraging results achieved to date, planning for the pilot plant test work programme is underway.”

Upcoming catalysts include:

2022 – EIA permit due.

2023 – DFS due.

Critical Elements Lithium Corp. [TSXV:CRE] [GR:F12] (OTCQX:CRECF)

On June 13, Critical Elements Lithium Corp. announced: “Critical Elements announces a positive feasibility study for the Rose Lithium Project generating an after-tax NPV at 8% of US$1.9b and an after-tax IRR of 82.4%.” Highlights include:

- “Average production, Year 2 to Year 16 of 173,317 tonnes of chemical grade 5.5% spodumene concentrate.

- Average production, Year 2 to Year 16 of 51,369 tonnes of technical grade 6.0% spodumene concentrate.

- Average production, Year 2 to Year 16 of 441 tonnes of tantalum concentrate.

- Expected life of mine of 17 years.

- Average operating costs of US$74.48 per tonne milled, US$540 per tonne of concentrate (all concentrate production combined).

- Estimated initial capital cost $US$357 million before working capital.

- 100% equity basis for project.

- Average gross margin of 68.3%.

- After-tax NPV of US$1,915 million (at 8% discount rate), after-tax IRR of 82.4% and average price assumptions of US$4,039 per tonne technical grade lithium concentrate, US$1,852 per tonne chemical grade lithium concentrate, US$130 per kg tantalum pentoxide (Ta2O5).

- Anticipated construction time to start of production of 21 months.”

Investors can view the company’s latest presentation here.

Upcoming catalysts include:

- 2022 – Rose Lithium-Tantalum Project provincial permitting. Possible off-take or financing announcements.

You can read the latest Trend Investing Critical Elements Lithium article here.

Lithium Power International Ltd. [ASX:LPI] (OTC:LTHHF)

On June 22, Lithium Power International announced: “Lithium Power International to consolidate 100% ownership of Maricunga Lithium Brine Project.” Highlights include:

- “LPI to consolidate 100% ownership of the Maricunga brine project, by way of a three-party all-scrip merger with its JV Partners MSB SpA (owner of 31.31% of Maricunga) and TSXV listed Bearing Lithium (17.14%).

- The Transactions increase the current LPI shareholders’ proportionate interest in Maricunga from the current 51.55% to ~57.9%.

- LPI will consolidate the ~48.45% of the Project that it does not currently own at a valuation which is a discount of ~17.1% compared with LPI’s current look through value of Maricunga.

- LPI holding 100% ownership of the Project will simplify decision-making and provides the optimal structure to oversee the rapid development of Maricunga.

- Consolidation of 100% of the Project’s ownership will de-risk the funding pathway and enhance LPI’s ability to source capital for the development of Maricunga from a wider range of providers when compared with the existing joint venture ownership structure.

- Consideration will be paid in LPI shares thereby allowing the shareholders of the JV Partners to retain exposure to the NPV8 US$1.4b Project.

- The Transactions have been unanimously endorsed by the Boards of LPI, Bearing and MSB SpA, with the LPI Board (other than Mr Martin Borda who abstained due to him being the ultimate controller of MSB SpA) recommending that LPI shareholders vote in favour of the Transactions at the upcoming shareholder meeting.”

Upcoming catalysts:

- 2022 – Further developments with Mitsui re off-take partner and funding announcements for Maricunga Lithium Brine Project in Chile. Spin-out of Western Australian Greenbushes and Pilgangoora lithium assets.

Lake Resources NL [ASX:LKE] [GR:LK1] (OTCQB:LLKKF)

Lake Resources own the Kachi Lithium Brine Project in Argentina. Lake has been working with Lilac Solutions Technology (private, and backed by Bill Gates) for direct lithium extraction and rapid lithium processing.

On June 17, Lake Resources NL announced: “Lake appoints Citi and J.P. Morgan as joint coordinators for proposed debt finance of the Kachi Lithium Project.” Highlights include:

- “Both Joint Coordinators (JCs) will work together on coordinating a debt financing package for Lake’s 50,000 tpa LCE Kachi Lithium Project.

- Debt financing based with a view to obtaining Export Credit Agency guarantees from UK Export Finance (UKEF) to cover approximately 70% of the total Kachi Project funding requirement, subject to standard project finance conditions.”

On June 20 Lake Resources announced:

Lake appoints Executive Chairman as it aligns operations to serve the critical North American supply chain…..Chairman Stu Crow to serve as Executive Chairman for six months to oversee the appointment of a new CEO, board members, and the establishment of US offices……As part of this transition to North America current Managing Director Steve Promnitz will depart after establishing Lake’s dominant position in Argentina.

ioneer Ltd [ASX:INR] [GR:4G1] (OTCPK:GSCCF)

ioneer Ltd announced in September 2021 the sale of 50% of its flagship lithium boron project to Sibanye Stillwater for US$490m.

No news for the month.

Upcoming catalysts include:

- Any debt funding deals on top of the existing Sibanye-Stillwater US$490m to fund Rhyolite Ridge.

European Metals Holdings Limited [ASX:EMH] [AIM:EMH] [GR:E861] (OTCPK:ERPNF) (OTCPK:EMHLF)(OTCPK:EMHXY)

No significant news for the month.

Upcoming catalysts include:

- 2022 – Any off-take or project funding deals.

Galan Lithium [ASX:GLN]

Galan is developing their flagship Hombre Muerto West (“HMW”) Lithium Project located on the west side edge of the high grade, low impurity Hombre Muerto salar in Argentina. In total Galan Lithium has 3.0m tonnes contained LCE @858mg/L.

On May 31, Galan Lithium announced: “Long term pumping tests to commence at HMW.” Highlights include:

- “Four (4) pumping wells to be tested at Pata Pila and Rana de Sal.

- Hydraulic and chemical data to support ongoing HMW Definitive Feasibility Study (DFS).

- Pumping test program expected to be finished by end Q3 CY2022.

- DFS on track for completion by end CY2022.”

On June 15, Galan Lithium announced: “First pegmatite lens discovered at Greenbushes South.” Highlights include:

- “Recent airborne radiometric, magnetic and DEM survey data processed for Greenbushes South Project.

- Interpretation provided 18 key target zones for lithium pegmatites near the mineralising Donnybrook-Bridgetown Shear Zone.

- Follow-up mapping and sampling of the first target site (GS11) resulted in a discovery of an approx. 200 m x 40 m outcropping pegmatite lens.

- Soil samples and rock chips from GS11 site sent for geochemical assay.

- Further fieldwork on GS11 and other key targets scheduled from July.

- Conservation Management Plan for pending tenements has reached final revision stage for planned H2 2022 exploration activities.”

Cypress Development Corp. (TSXV:CYP) (OTCQB:CYDVF)

Cypress Development owns tenements in the Clayton Valley, Nevada, USA.

On June 13, Cypress Development Corp. announced:

Cypress Development delivers solution from pilot plant for testing production of lithium carbonate and lithium hydroxide. “The Company is very pleased to have reached this significant milestone. About 4,000 liters of concentrated lithium chloride solution have been delivered from the Pilot Plant to two Canadian laboratories. Each laboratory is now working to further treat the solutions, one to produce lithium carbonate, and the other, lithium hydroxide, as the final end product…..“These results will then be used to determine what additional steps are needed, if any, to attain battery-grade standards and evaluate the alternatives for producing these products in the ongoing Feasibility Study.”

On June 15, Cypress Development Corp. announced: “Cypress Development progress on feasibility study.” Highlights include:

- “Geotechnical study in progress.

- Continued operation of the Pilot Plant.

- 500-ton bulk sample collected for further metallurgical material.

- Sonic drill program completed consisting of 580 meters in eight drill holes.

- Resource model updated with data from recently acquired property.”

On June 21, Cypress Development Corp. announced:

Cypress Development announces positive direct lithium extraction results. Cypress Development Corp…….is pleased to announce positive results from the Direct Lithium Extraction (“DLE”) portion of its Lithium Extraction Facility (“Pilot Plant”) in Amargosa Valley, Nevada. Assays received from samples collected during continuous operating cycles in March, April, and May, 2022, revealed an average lithium recovery of 99.5% within the DLE portion of the Pilot Plant. These high lithium recoveries were accompanied with high levels of impurity rejection.

Frontier Lithium Inc. [TSXV:FL] (OTCQX:LITOF)

Frontier Lithium own the PAK Lithium (spodumene) Project comprising 26,774 hectares and located 175 kilometers north of Red Lake in northwestern Ontario. The PAK deposit is a lithium-cesium-tantalum [LCT] type pegmatite containing high-purity, technical-grade spodumene (below 0.1% iron oxide).

On June 7, Frontier Lithium announced: “Drill results extend the Spark lithium deposit strike length by 80 metres to the West and discovers a new mineralized zone.” Highlights include:

- “DDH PL-054-22 intersected 95m of 1.31% Li2O from 2.6 to 97.6m including 26m of 2.38% Li2O with elevated Ta2O5 of 200 ppm.

- DDH PL-055-22 intersected 69.5m averaging 1.39% Li2O from 16.5 to 86m. A highly enriched 22.5m tantalum zone was intersected from 180 to 202.6m grading 754 ppm Ta2O5 with the lower 8.6 m averaging just over 0.1% Ta2O5.

- DDH PL-056-22 intersected an upper (81.5m) and lower (94.3m) mineralized pegmatite zones grading 1.35 and 1.34% Li2O; The lower zone (219 to 313m) was unexpected and appears to be an en-echelon extension of the Spark deposit to the NW. Between the upper and lower zones, narrower (7.1 and 12.9m) spodumene-bearing aplitic zones occur with elevated tantalum (up to 536 ppm Ta2O5) and rubidium (up to 0.74% Rb2O).

- Geomechanical hole PL-GDH-09-22 intersected high-grade spodumene from surface to 24.3m averaging 2.46% Li2O; Includes an upper 10m zone averaging 3.64% Li2O.”

Leo Lithium Limited [ASX:LLL] (Firefinch Limited spinout 50/50 JV with Ganfeng Lithium)

On May 31, Firefinch Limited announced: “Leo Lithium raises $100 million in IPO and timetable update.” Highlights include:

- “Leo Lithium Limited initial public offering to raise up to $100 million has closed oversubscribed.

- Pro rata and shortfall offer strongly supported by Firefinch shareholders.

- All conditions to the demerger of Leo Lithium Limited from Firefinch, other than shareholder approval, now satisfied.”

On June 23, Leo Lithium announced: “Leo lithium commences trading on ASX.” Highlights include:

- “Leo Lithium to officially commence trading on ASX today at 11.00 am AEST under the code LLL.

- Leo Lithium is developing the world-class Goulamina Lithium Project which represents the next lithium project of significant scale to enter production and an important strategic asset for the world’s growing demand for lithium.

- Following an oversubscribed initial public offering which raised A$100 million, combined with funding from JV partner Ganfeng Lithium Co. Ltd, Leo Lithium is substantially funded through to Stage 1 production.”

American Lithium Corp. [TSXV: LI] (OTCQB:LIACF) (acquired Plateau Energy Metals Inc.)

On May 26, American Lithium Corp. announced:

American Lithium secures additional private water rights for planned operations at TLC…..Pursuant to the terms of the agreement, the Company will pay the Vendors a total of US $3,125,000 on closing. Closing is expected to occur shortly following completion of a standard escrow in order to verify title rights.

On June 1, American Lithium Corp. announced: “American Lithium adds further concessions close to its existing projects in Southern Peru.”

Wealth Minerals Ltd. [TSXV:WML] [GR:EJZN] (OTCQB:WMLLF)

Wealth Minerals has a portfolio of lithium assets in Chile, such as 46,200 Has at Atacama, 8,700 Has at Laguna Verde, 6,000 Has at Trinity, 10,500 Has at Five Salars. Also the right to acquire a 100% interest in the Ignace REE Lithium Property in Ontario, Canada.

On June 13, Wealth Minerals announced:

Wealth Minerals begins drilling on the Ollagüe Salar Project. Wealth’s drill program comprises approximately five holes for a total of 1,500m of diamond drilling. This drill campaign will test brine anomalies as interpreted by prior geophysical studies. The campaign’s results will be augmented by exciting earlier third party drill information Wealth identified on the Project via its recent acquisition of 1,600 ha in the same Ollagüe Salar (see press release dated May 3, 2022). The Company anticipates publishing a maiden NI 43-101 compliant resource on the Project following the completion of drilling, laboratory work and analyses…..

On June 23, Wealth Minerals announced:

Wealth Minerals completes acquisition of additional ground in Ollagüe Salar…..reports the Company has received TSX Venture Exchange (“TSXV”) acceptance of the agreement with Lithium Chile Inc. (TSXV: LITH) (“Lithium Chile”) to acquire 1,600 hectares (“New Ollagüe Licenses”) adjacent and near-adjacent to its existing license position in the Ollagüe basin (the “Transaction”) (see news release dated May 3, 2022). Pursuant to the terms of the agreement, the Company has issued 2,000,000 shares of Wealth Minerals to Lithium Chile Inc. Any future payments required under the Transaction will be subject to TSXV acceptance……

Investors can view the company’s latest presentation here.

E3 Lithium Ltd. [TSXV:ETMC] (OTCPK:EEMMF) (Formerly E3 Metals)

E3 Lithium Ltd. is a lithium development company focused on commercializing its extraction technology and advancing the world’s 7th largest lithium resource with operations in Alberta. E3 has an inferred mineral resource of 6.7 million LCE.

On May 31, E3 Metals announced: “E3 Metals to become E3 Lithium.”

On June 8, E3 Lithium Ltd. announced: “E3 Lithium to drill first of its kind well in Alberta.”

On June 23, E3 Lithium Ltd. announced: “Imperial and E3 Lithium form strategic agreement on lithium pilot project in Alberta. Imperial and E3 Lithium form strategic agreement on lithium pilot project in Alberta.” Highlights include:

- “Advances E3 Lithium’s Clearwater Project with Imperial funding contribution.

- Pilot project progresses commercialization of battery-grade lithium from historic Leduc field for electric vehicles and energy storage.

- Imperial to provide technical and development support.”

You can read the company’s latest presentation here.

Iconic Minerals Ltd. [TSXV:ICM] [FSE:YQGB] (OTCPK:BVTEF)/ Nevada Lithium Corp. [CSE: NVLH]

Joint Venture (Nevada Lithium Corp. earn in option to 50%) in the Bonnie Claire Project in Nevada, USA; with an Inferred Resource of 18.68 million tonnes LCE.

On June 13, Iconic Minerals announced:

Iconic Minerals announces exploration update for Bonnie Claire Lithium Project. Iconic Minerals Ltd…..and its 50% joint venture partner in Bonnie Claire, Nevada Lithium Resources Inc….., are pleased to announce that drilling of the Bonnie Claire Lithium Project (the “Project” or “Property”) is underway and proceeding according to plan. The planned drill program will entail drilling from five (5) separate drill sites (See news release dated May 4, 2022), which are spaced approximately one-half mile apart and being drilled to a depth of 2,000 feet (610 meters)…… Iconic Mineral’s CEO, Richard Kern, stated, “After a longer than expected permitting process, we are delighted to begin final definition of this very large lithium resource.”

Arena Minerals Inc. [TSXV:AN] (OTCPK:AMRZF)

On May 24, Lithium Americas announced:

Lithium Americas enters collaboration agreement with Arena Minerals….. “Arena’s Sal de la Puna project is adjacent to our recently acquired 100%-owned Pastos Grandes project, and together, we will collaborate to develop the basin in the most sustainable and efficient way for all stakeholders.”……The Collaboration Agreement also includes the common use of infrastructure owned by both Lithium Americas and Arena, so long as the use does not interfere with the operation of the respective projects. The infrastructure includes a fully equipped on-site analytical laboratory, pilot ponding facilities, a pilot carbonate conversion plant and ancillary camp infrastructure.

Rio Tinto Group [ASX:RIO] [LN:RIO] (RIO)

On June 9, Rio Tinto announced: “Nano One and Rio Tinto announce strategic partnership and US$10m investment.” Highlights include:

- “Rio Tinto makes US$10M strategic equity investment in Nano One.

- Rio Tinto to collaborate on battery metals as inputs for Nano One’s cathode process technologies.

- Partnership accelerates commercialization of Nano One’s One-Pot and M2CAM® technologies. Adds to Government of Canada’s Mines-to-Mobility initiative for North American battery ecosystem. Québec focus on Rio Tinto’s iron production in Sorel-Tracy and Nano One’s pending LFP facility in Candiac.”

Lithium South Development Corp. [TSXV:LIS] (OTCQB:LISMF)

On June 21, Lithium South Development Corp. announced:

Lithium South Begins Drilling at Alba Sabrina Claim Block HMN Li Project, Argentina….. The drilling method is diamond drill hole with double packer sampling at select intervals. The 2,000-meter drill program is expected to continue for the next several months, with results reported as obtained. The program is being supervised by Dr. Mark King, a Qualified Person under National Instrument 43-101, and Principal Hydrogeologist and President of Groundwater Insight, Inc. Dr. King has an extensive background in lithium brine resource and reserve estimation. The objective of the program is to potentially expand the current Lithium Carbonate Resource which is defined as 756 parts per million lithium within 571,000 tonnes in the Measured and Indicated Categories with a low magnesium to lithium ration of 2.6 to 1.0…..

Alpha Lithium Corp. [TSXV:ALLI][GR:2P62] (OTCPK:APHLF)

No news for the month.

International Lithium Corp. [TSXV:ILC] (OTCPK:ILHMF)

No news for the month.

Lithium Energy Limited [ASX:LEL]

On May 26, Lithium Energy Limited announced:

Clarification – Exploration target at Solaroz Lithium Project….. Lithium Energy would like to clarify that its previously defined Exploration Target for Solaroz is within a range of: 1.5 to 8.7 million tonnes of contained Lithium Carbonate Equivalent (LCE) based on a range of lithium concentrations of between circa 500 mg/L Lithium (Li) and 700 mg/L Li1

Argentina Lithium & Energy Corp. [TSXV: LIT] (OTCQB: OTCQB:PNXLF)

On May 31, Argentina Lithium & Energy Corp. announced:

Argentina Lithium commences exploration drilling at Rincon West….. Five exploration holes are initially planned to test multiple prospective brine targets identified from the geophysical survey data announced in the News Release dated May 2, 2022. This drill program is expected to require four months to complete. The Rincon West project covers 2470 hectares of the salar basin, located west of the adjacent Rincon Project owned by Rio Tinto. Previously announced geophysics results delineated highly conductive units consistent with concentrated brine aquifers over 64% of the property area……

Avalon Advanced Materials Inc. [TSX:AVL] [GR:OU5] (OTCQX:AVLNF)

Avalon has three projects in Ontario, Canada, and five in total throughout Canada. Avalon’s most advanced project is the Separation Rapids Lithium Project in Ontario with a M& I Resource estimate of the 8.2MT at 1.37% Li2O and 0.36% Rb2O plus Inferred 1.2MT at 1.33% Li2O and 0.361% Rb2O. Avalon is working on a plan for a JV to build a lithium-ion battery materials refinery in Thunder Bay, Ontario.

No news for the month.

Essential Metals Limited [ASX:ESS] (OTCPK:PIONF)

Essential Metals has 9 projects (lithium, gold, gold JV, and nickel JV) all in Western Australia. Their flagship Pioneer Dome Lithium (spodumene) Project has a JORC Compliant Total Resource of 11.2Mt at 1.21% Li2O.

On May 26, Essential Metals announced:

Pioneer Dome Lithium Project – Drilling and development activities update. 9,000m extensional drill programme underway.

On June 7, Essential Metals announced: “Assays confirm high-grade near-surface lithium at Cade and Davy. Outstanding assays including 23.7m @ 1.26% Li2O from 3.6m (PDD599) in the Cade deposit and 31.95m @ 1.24% Li2O from 45.4m (PDD601) in the Davy deposit.” Highlights include:

- “Cade Deposit assay results include: 19.2m @ 1.44% Li2O from 15m (PDD596). 9.6m @ 1.42% Li2O from 14.4m (PDD598). 23.7m @ 1.26% Li2O from 3.6m (PDD599). 18.9m @ 1.24% Li2O from 21.1m (PDD600). 14.7m @ 0.90% Li2O from 11.6m (PDD595)

- Davy Deposit assay results include: 31.95m @ 1.24% Li2O from 45.4m (PDD601). 17m @ 1.32% Li2O from 97.1m (PDD605). 18.7m @ 1.05% Li2O from 17m (PDD603). 11.1m @ 1.70% Li2O from 99.2m (PDD604)

- The diamond drilling [DD] programme undertaken in the March quarter consisted of six holes drilled into the first ~40m from surface of the Cade Deposit and seven holes drilled into the Davy Deposit for a total of 909m of drilling……”

Green Technology Metals [ASX: GT1]

Green Technology Metals [ASX:GT1] (“GT1”) has several very promising lithium projects near Thunder Bay in Ontario, Canada. The current JORC Total Mineral Resource is 4.8Mt @ 1.25% with a projects (spodumene) wide target resource of 50-60 MT @ 0.8-1.5% Li2O.

On May 26, Green Technology Metals announced: “Western heli-mag surveying commenced.”

On June 23, Green Technology Metals announced: “Interim Seymour Mineral Resource doubles to 9.9mt.” Highlights include:

- “Total Mineral Resource tonnage up 105% to 9.9 Mt @ 1.04% Li2O.

- Indicated Category Mineral Resource increased 2.5x to 5.2 Mt @ 1.29% Li2O.

- Approximately 53% of total Seymour Mineral Resource classified as Indicated.

- North Aubry deposit remains open along strike and at depth.

- Further step-out drilling of North Aubry set to continue over H2 2022.

- Very low discovery cost for new resources circa $1.30 tonne.”

Battery recycling, lithium processing and new cathode technologies

Rock Tech Lithium Inc. [CVE:RCK](OTCQX:RCKTF)

No news for the month.

Neometals Ltd (OTC:RRSSF) (Nasdaq:RDRUY) [ASX:NMT]

No significant news for the month.

Nano One Materials Corp. (TSX: NANO) (OTCPK:NNOMF)

On May 31, Nano One announced: “Nano One and BASF enter into a joint development agreement for lithium-ion battery materials.” Highlights include:

- ” Evaluation of Nano One’s patented M2CAM® One-Pot process for BASF’s next-generation cathode active materials.

- Multi-phase agreement includes detailed commercialization study for pre-pilot, pilot and scaled up production.”

On June 17, Nano One announced: “Nano One announces closing of Rio Tinto strategic investment and collaboration agreement…..”

Other lithium juniors

Other juniors include: 5E Advanced Materials Inc. [ASX:5EA] (FEAM), American Lithium Minerals Inc. (OTCPK:AMLM), Anson Resources [ASX:ASN] [GR:9MY], Ardiden [ASX:ADV], Arizona Lithium [ASX:AZL] (AZLAF), Atlantic Lithium [LON:ALL] (OTCPK:ALLIF), Bradda Head Lithium Limited [LON:BHL] (BHLIF) (OTCPK:CDCZF), Bryah Resources Ltd [ASX:BYH], Carnaby Resources Ltd [ASX:CNB], Critical Resources [ASX:CRR], Electric Royalties [TSXV:ELEC], Eramet [FR: ERA] (OTCPK:ERMAF) (OTCPK:ERMAY), European Lithium Ltd. [ASX:EUR] (OTCPK:EULIF), Foremost Lithium Resource & Technology [CSE:FAT] (OTCPK:FRRSF), Greenwing Resources Limited [ASX:GW1] (OTCPK:BSSMF), HeliosX Lithium & Technologies Corp. [TSXV:HX] (formerly Dajin Lithium Corp. [TSXV:DJI]), Hannans Ltd [ASX:HNR], Infinity Lithium [ASX:INF], International Battery Metals [CSE: IBAT] (OTCPK:IBATF), Ion Energy [TSXV:ION], Jadar Resources Limited [ASX:JDR], Kodal Minerals (LSE-AIM: KOD), Larvotto Resources [ASX:LRV], Latin Resources Ltd. [ASX:LRS] (OTC:LAXXF), Lepidico [ASX:LPD] (OTCPK:LPDNF), Liberty One Lithium Corp. [TSXV:LBY] (OTCPK:LRTTF), Lithium Australia [ASX:LIT] (OTC:LMMFF), Lithium Chile Inc. [TSXV:LITH][GR:KC3] (OTCPK:LTMCF), Lithium Corp. (OTCQB:LTUM), Lithium Energi Exploration Inc. [TSXV:LEXI](OTCPK:LXENF), Lithium Ionic Corp. [TSXV:LTH], Lithium Plus Minerals [ASX:LPM], Metals Australia [ASX:MLS], MetalsTech [ASX:MTC], MinRex Resources [ASX:MRR], MGX Minerals [CSE:XMG] (OTC:MGXMF), New Age Metals [TSXV:NAM] (OTCQB:NMTLF), Noram Lithium Corp. [TSXV:NRM] (OTCQB:NRVTF), One World Lithium [CSE:OWLI] (OTC:OWRDF), Patriot Battery Metals [CSE:PMET] (OTCQB:PMETF), Portofino Resources Inc.[TSXV:POR] [GR:POT], Power Metals Corp. [TSXV:PWM] (OTCPK:PWRMF), Prospect Resources [ASX:PSC], Pure Energy Minerals [TSXV:PE] (OTCQB:PEMIF), Quantum Minerals Corp. [TSXV:QMC] (OTCPK:QMCQF), Snow Lake Lithium (LITM), Spearmint Resources Inc. [CSE:SPMT] (OTCPK:SPMTF), Surge Battery Metals Inc. [TSXV:NILI] (OTCPK:NILIF), Ultra Lithium Inc. [TSXV:ULI] (OTCQB:ULTXF), United Lithium Corp. [CSE:ULTH] [FWB:0UL] (OTCPK:ULTHF), Vision Lithium Inc. [TSXV:VLI] (OTCQB:ABEPF), Winsome Resources Limited [ASX:WR1], Zinnwald Lithium [LN:ZNWD].

Conclusion

June saw lithium chemicals prices higher and spodumene prices higher.

Highlights for the month were:

- Sayona Mining raises A$190m institutional placement to fund NAL restart and broader development initiatives.

- Stellantis to become substantial shareholder in Vulcan Energy through A$76m (€50M) equity investment.

- POSCO inks MOU deal with Australia’s Hancock to secure raw materials for EV batteries.

- Liontown and Tesla execute binding Offtake Agreement.

- Global Lithium Resources: Marble Bar Lithium Project assays continues to deliver on exploration success.

- Critical Elements announces positive FS for the Rose Lithium Project with an after-tax NPV8% of US$1.9b and an after-tax IRR of 82.4%.

- Lithium Power International to consolidate 100% ownership of Maricunga Lithium Brine Project.

- Lake Resources Managing Director Steve Promnitz departs.

- Galan Lithium first pegmatite lens discovered at Greenbushes South.

- Cypress Development announces positive direct lithium extraction results.

- Frontier Lithium drills 95m of 1.31% Li2O from 2.6 to 97.6m, extends the Spark lithium deposit strike length by 80 metres.

- Leo Lithium raises A$100 million in IPO, ticker ASX:LLL.

- Wealth Minerals completes acquisition of additional ground in Ollagüe Salar in Chile.

- Imperial and E3 Lithium form strategic agreement on lithium pilot project in Alberta.

- Lithium South Begins Drilling at Alba Sabrina Claim Block HMN Li Project, Argentina.

- Argentina Lithium commences exploration drilling at Rincon West.

- Essential Metals assays confirm high-grade near-surface lithium at Cade and Davy, including 23.7m @ 1.26% Li2O from 3.6m (PDD599) and 31.95m @ 1.24% Li2O from 45.4m (PDD601).

- Green Technology Metals Total Mineral Resource tonnage up 105% to 9.9 Mt @ 1.04% Li2O.

- Nano One and BASF enter into a joint development agreement for lithium-ion battery materials. Nano One and Rio Tinto announce strategic partnership and US$10m investment.

As usual, all comments are welcome.

[ad_2]

Source link