[ad_1]

The large shareholder teams in dMY Know-how Team, Inc. VI (NYSE:DMYS) have electricity around the organization. Institutions normally possess shares in far more founded corporations, whilst it really is not uncommon to see insiders personal a good little bit of more compact businesses. I typically like to see some degree of insider possession, even if only a small. As Nassim Nicholas Taleb reported, ‘Don’t inform me what you think, convey to me what you have in your portfolio.

dMY Technological innovation Team VI is not a large organization by world wide standards. It has a market place capitalization of US$306m, which signifies it would not have the notice of numerous institutional buyers. Getting a appear at our information on the possession teams (beneath), it seems that institutions possess shares in the company. Let us delve deeper into each individual kind of owner, to find out far more about dMY Engineering Team VI.

Watch our most recent assessment for dMY Engineering Team VI

What Does The Institutional Ownership Inform Us About dMY Engineering Group VI?

Institutional traders generally examine their own returns to the returns of a typically adopted index. So they usually do think about obtaining more substantial providers that are bundled in the applicable benchmark index.

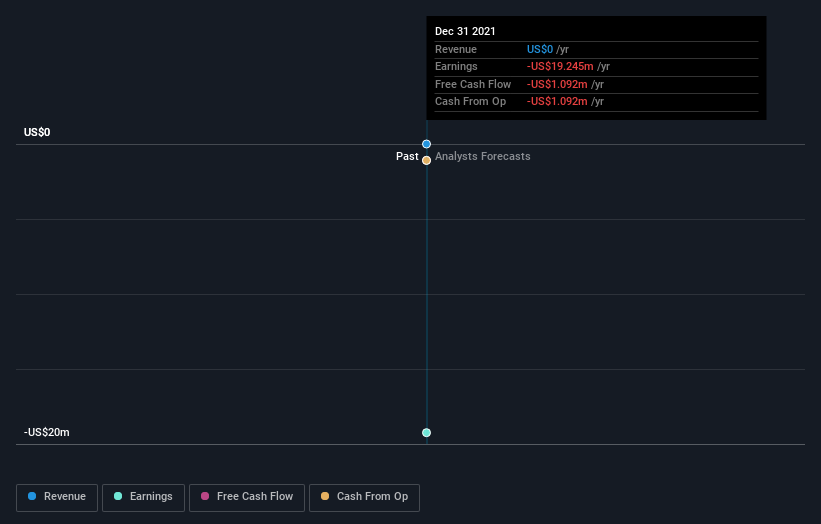

dMY Technological know-how Team VI already has establishments on the share registry. In fact, they possess a respectable stake in the enterprise. This can reveal that the firm has a specific degree of credibility in the expenditure local community. Having said that, it is most effective to be wary of relying on the meant validation that arrives with institutional buyers. They also, get it wrong occasionally. If numerous establishments modify their perspective on a stock at the same time, you could see the share cost drop fast. It’s consequently truly worth looking at dMY Technological innovation Group VI’s earnings background beneath. Of course, the long term is what really issues.

Institutional investors individual over 50% of the corporation, so collectively than can in all probability strongly impact board conclusions. We take note that hedge money never have a significant financial commitment in dMY Technological innovation Group VI. Our details reveals that Harry You is the biggest shareholder with 20% of shares outstanding. With 3.6% and 3.3% of the shares superb respectively, Governors Lane LP and Woodline Partners LP are the next and third greatest shareholders.

After undertaking some additional digging, we observed that the best 13 have the put together possession of 51% in the business, suggesting that no solitary shareholder has major regulate about the business.

Studying institutional possession is a excellent way to gauge and filter a stock’s predicted efficiency. The exact can be achieved by learning analyst sentiments. As much as we can inform there just isn’t analyst protection of the company, so it is most likely flying underneath the radar.

Insider Ownership Of dMY Know-how Group VI

The definition of an insider can differ somewhat between diverse international locations, but customers of the board of administrators generally count. The corporation management answer to the board and the latter need to stand for the passions of shareholders. Notably, from time to time top rated-stage professionals are on the board themselves.

I usually contemplate insider possession to be a excellent issue. However, on some instances it would make it extra complicated for other shareholders to keep the board accountable for choices.

Our most modern details implies that insiders own a reasonable proportion of dMY Know-how Group, Inc. VI. It has a sector capitalization of just US$306m, and insiders have US$60m worth of shares in their possess names. We would say this demonstrates alignment with shareholders, but it is truly worth noting that the firm is still really tiny some insiders may perhaps have established the business. You can click on right here to see if all those insiders have been getting or selling.

Basic Community Possession

The common public– which includes retail buyers — own 25% stake in the company, and for this reason are not able to conveniently be dismissed. Whilst this sizing of ownership could not be adequate to sway a coverage determination in their favour, they can even now make a collective impression on business insurance policies.

Up coming Actions:

It is usually value imagining about the unique teams who own shares in a business. But to have an understanding of dMY Technological innovation Team VI better, we need to have to consider numerous other variables. Take into account for occasion, the at any time-current spectre of expenditure danger. We’ve discovered 4 warning signs with dMY Engineering Group VI (at least 2 which are concerning) , and being familiar with them should really be element of your financial investment method.

If you would choose look at out another corporation — a single with possibly remarkable financials — then do not miss this absolutely free list of exciting firms, backed by robust monetary facts.

NB: Figures in this posting are calculated using knowledge from the previous twelve months, which refer to the 12-thirty day period period ending on the final date of the thirty day period the financial statement is dated. This might not be dependable with comprehensive year once-a-year report figures.

Have suggestions on this post? Concerned about the material? Get in touch with us specifically. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This short article by Only Wall St is basic in mother nature. We present commentary based mostly on historical info and analyst forecasts only using an unbiased methodology and our article content are not intended to be economic tips. It does not represent a advice to buy or provide any inventory, and does not just take account of your objectives, or your economical problem. We aim to deliver you prolonged-time period concentrated evaluation driven by basic details. Notice that our examination may well not element in the newest cost-delicate organization announcements or qualitative substance. Just Wall St has no position in any stocks pointed out.

[ad_2]

Supply link