[ad_1]

Microchip Know-how (NASDAQ:MCHP) has observed the following analyst rankings inside the past quarter:

| Bullish | Fairly Bullish | Indifferent | Relatively Bearish | Bearish | |

|---|---|---|---|---|---|

| Full Rankings | 3 | 4 | 4 | ||

| Final 30D | 1 | ||||

| 1M Ago | |||||

| 2M Ago | 2 | 3 | 3 | ||

| 3M In the past | 1 | 1 |

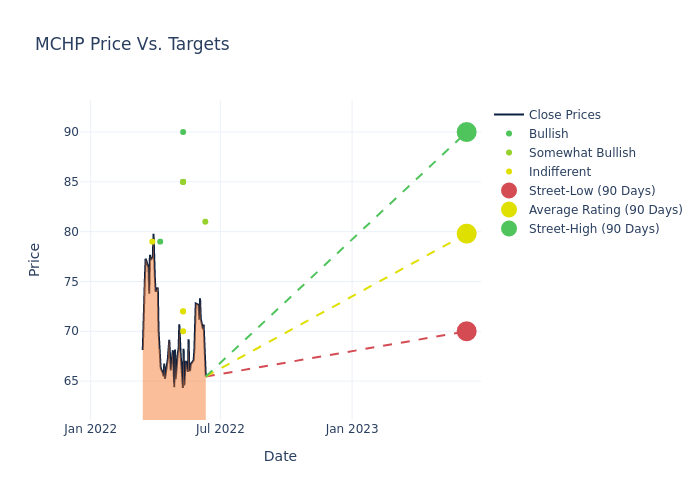

According to 11 analyst providing 12-month rate targets in the previous 3 months, Microchip Technology has an ordinary cost concentrate on of $80.27 with a substantial of $90.00 and a very low of $70.00.

Down below is a summary of how these 11 analysts rated Microchip Engineering about the earlier 3 months. The bigger the variety of bullish scores, the more beneficial analysts are on the inventory and the higher the variety of bearish ratings, the far more detrimental analysts are on the inventory

This present ordinary has reduced by 12.46% from the earlier regular value focus on of $91.70.

Benzinga tracks 150 analyst corporations and stories on their inventory anticipations. Analysts typically arrive at their conclusions by predicting how considerably funds a corporation will make in the future, generally the forthcoming five decades, and how dangerous or predictable that company’s profits streams are.

Analysts go to corporation convention calls and meetings, investigation firm economic statements, and converse with insiders to publish their scores on stocks. Analysts typically amount every single stock once per quarter or when the corporation has a important update.

Some analysts publish their predictions for metrics this sort of as development estimates, earnings, and earnings to give supplemental direction with their ratings. When making use of analyst rankings, it is vital to keep in mind that stock and sector analysts are also human and are only featuring their views to traders.

This article was produced by Benzinga’s automatic articles motor and reviewed by an editor.

[ad_2]

Supply connection