[ad_1]

Micron Know-how (MU) was reviewed on May possibly 13 and we recommended that “Equivalent to other stocks that have suffered declines, MU could phase a short term rebound in price tag but the for a longer period-term picture implies further price weak point ahead. I would sit out any in the vicinity of-phrase bounce in MU as the double top rated pattern concerns me.”

Let’s verify the charts once again.

In this day by day bar chart of MU, beneath, we can see that shares of MU have designed an island leading reversal by gapping increased in late May perhaps and gapping decreased now. A retest of the April-May lows appears to be like it could be the subsequent move for MU. Rates are again underneath the declining 50-day going typical line. The slope of the 200-day line is nonetheless unfavorable.

The On-Stability-Volume (OBV) line has been neutral/steady the earlier two months. The Relocating Regular Convergence Divergence (MACD) oscillator was edging up to the underside of the zero line but now it is more most likely to transform lessen again.

In this weekly Japanese candlestick chart of MU, below, we see a combined photo. This week’s candle is not plotted yet so we nonetheless see additional reduced shadows than higher shadows. The slope of the 40-week going typical seems to be neutral.

The weekly OBV line looks like it displays some advancement in Could. The MACD is beneath the zero line but has narrowed in direction of a possible deal with shorts invest in sign in the weeks in advance.

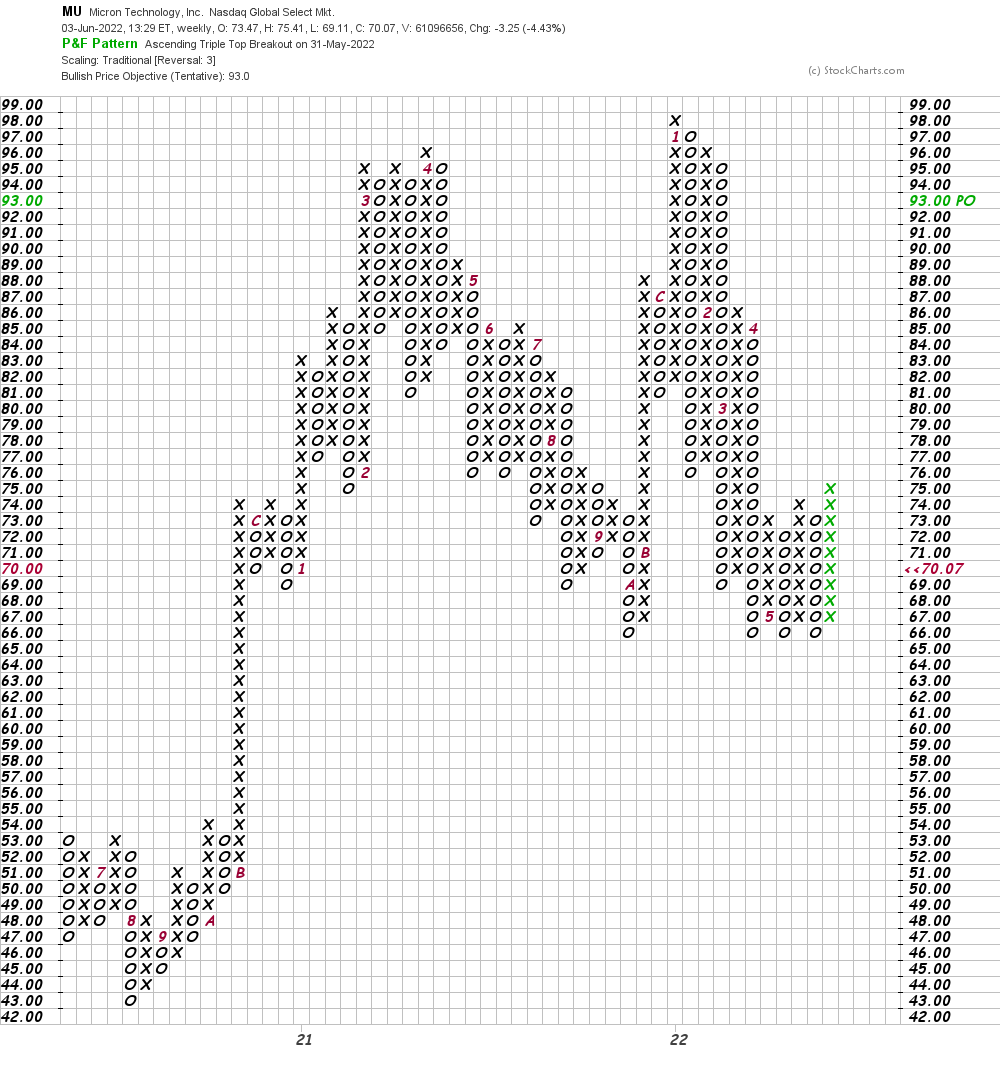

In this day by day Position and Determine chart of MU, under, we can see a potential upside cost target in the $93 region.

In this weekly Place and Determine chart of MU, down below, we can see the identical $93 value concentrate on as the daily chart.

Base line system: MU may perhaps go on to hold the $65 amount but a close down below $65 on elevated quantity will suggestion the scales in direction of the bears. Continue to be tuned.

Get an e-mail warn each time I produce an write-up for Real Funds. Click on the “+Comply with” future to my byline to this post.

[ad_2]

Resource website link